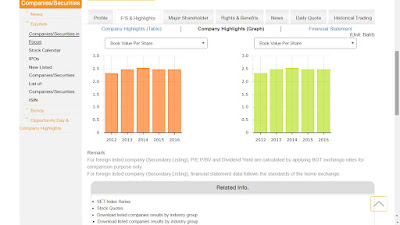

Book Value per share (Baht)

Data Secondary

The

price per share, the average of the net value represents any of the assets to

shareholders per ordinary shares, one of which is the price at which one day

calculated from the balance sheet of the company as at that date, it will be

worth.

Company Highlights

(Graph)

The

amount of money that the shareholder is entitled to a refund by assuming the

company liquidation in those days and is located on the assumption that the

company's total assets were sold at a price based on the account that appears

on the balance sheet and the market price of an asset will not be as of the day

the consideration per share price.

Data Analysis

Book Value is the value of assets on its

balance sheet. Can be calculated from the Total assets minus total liabilities

(Book Value is equal to the difference between total assets and total

liabilities) theoretically, if the company shut down and sell assets after

payment of all liabilities. Share of the remaining assets will be returned to

the shareholders of the Company divided proportionally equal the book value per

share is equal to the Book Value of Shareholders.

Book value = assets – liabilities

Book Value per Share = Book Value /

number of shares all the companies issued and paid-up.

Company Highlights (Table)

|

Book Value per share

(Baht)

|

2012

|

2013

|

2014

|

2015

|

216

|

|

2.33

|

2.47

|

2.53

|

2.47

|

2.47

|

From the above data, it can be seen that in

the year 2012 – 2016, found that in Book Value per share the average annual increase rate of

0.14% of the approximately million Baht. (140,000). In 2012-2013 Book Value per share increased 0.14%

(140,000THB) and in 2013-2014 Book Value per share increased 0.06% (60,000THB)

later in the year 2014-2015 Book Value per share decreased 0.06% (60,000THB),

but in the years 2015-2016 Book value per share is the same at 2.47

Reference : www.set.or.th

ไม่มีความคิดเห็น:

แสดงความคิดเห็น